In 2018, we launched our first insurance products in collaboration with our partners. Right from the start, we had a strong incentive to distribute insurance products both directly and through co-brokering, addressing brokers not accredited by our partners.

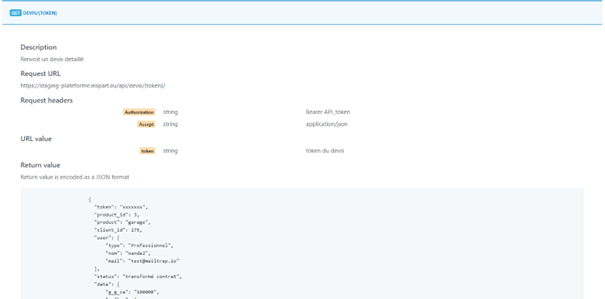

Subsequently, we developed our multichannel insurance distribution platform to expand the reach of our products:

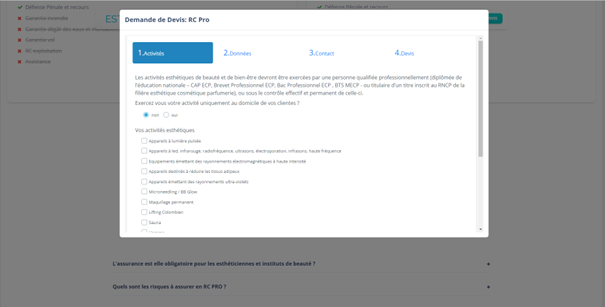

We tested this platform on various products, accumulating hundreds of clients, and also developed a no-code implementation solution. A tunnel is generated solely through module settings without a single line of code. Today, we take a new step by implementing an engineering product liability insurance in less than a week, including the creation of a showcase website.

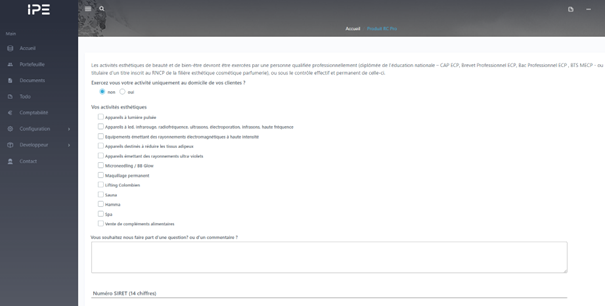

Product configuration is relatively straightforward without code and involves about twenty steps. The subscription tunnel is created using simplified widgets that can be interconnected or conditional, with customizable displays for each intermediary.

The challenge with most existing platforms is their lack of modularity for multi-channel distribution and parameterization for serial product launches. Managing a contract from start to finish becomes complex post-subscription. After subscription, management tasks include:

To minimize administrative burdens, we chose to automate extensively through our platform, configuring all possible options. Operating primarily with technically complex products in terms of pricing, documentation, and contracts, we dedicated ourselves to creating a robust, reliable, and customizable platform.

This week, we launched a new product, the "Decennale" liability insurance, taking only a week to:

The entire product tunnel required no code, with the showcase website being the most time-consuming, requiring some SEO optimization coding.

With the IPE platform, the multi-channel distribution of new products achieves new records! Tomorrow, we'll share details about our aggregation platform, enabling real-time multi-channel and multi-distributor portfolio tracking in the insurance industry !